京东白条消费信贷资产证券化分析毕业论文

2020-04-13 11:45:06

摘 要

互联网技术的崛起为电子商务的发展提供了肥沃的土壤。京东、淘宝、苏宁等巨头迅速发展,微型电商不计其数,行业竞争日益激烈。在这样一个严苛的大环境下,京东通过推出京东白条实现了交易额节节攀升。京东白条规模的迅速增长为京东集团带来潜在的流动性风险。京东集团通过消费信贷资产证券化的新型表外融资方式成功解决了流动性危机。

本文运用案例研究法,对京东白条消费信贷资产证券化的动因与效果进行详细分析,并得出了一般性结果。首先本文对资产证券化与互联网消费信贷的基础理论进行阐述。其次从京东集团资产的流动性、再投资效率、融资渠道和融资成本这四个角度分析了京东白条消费信贷资产证券化的动因。接着通过京东白条应收账款债权资产支持专项计划有关数据对资产证券化项目进行效果分析。最后提出完善京东白条消费信贷资产证券化的建议。

本文研究发现:(1)京东集团通过京东白条迅速扩大了市场份额,使资产规模迅速扩大(2)京东白条降低了了京东集团资产的流动性(3)京东白条消费信贷资产证券化有效的补充了企业资产的流动性,但也带来新的风险(4)京东白条消费信贷资产证券化作为一种表外融资方式有效的改善了企业的财务结构(5)专项计划中采取的循环交易结构提供了充足的现金流以应对资产支持证券的本息。

本文特色:(1)系统的介绍了资产证券化的过程,互联网消费信贷的现有融资方式进行归纳(2)根据现有的数据,通过进行一系列的假设,对京东白条消费信贷资产证券化的结构等进行简化分析。再逐步放宽假设条件,最终得出结论。

关键词:京东白条;互联网消费信贷;资产证券化;资产流动性;融资成本

Abstract

The rise of Internet technology provides fertile soil for the development of e-commerce. The giants such as JD.com, Taobao and Suning are developing rapidly. There are countless micro-e-commerce companies, and the industry competition is increasingly fierce. In such a harsh environment, JD.com has achieved a rapid increase in transaction volume through the introduction of JD.com Consumer Credit Line. The rapid growth in the scale of JD.com Consumer Credit Line has brought potential liquidity risks. JD.com successfully solved the liquidity crisis through the off-balance sheet financing method of consumer credit assets backed securitization.

This paper uses case study method to make a detailed analysis of the causes and effects of the assets backed securitization of JD.com Consumer Credit Line. And we obtained the general results. First of all, this paper elaborates the basic theories of assets backed securitization and Internet consumer credit. Secondly, this paper analyzes the motivation of the assets backed securitization of JD.com Consumer Credit Line from four angles: liquidity, reinvestment efficiency, financing channels and financing costs. Then, the effect of the assets backed securitization of JD.com Consumer Credit Line was analyzed through the data related to the special program. Finally, the paper puts forward some Suggestions to improve the assets backed securitization of JD.com Consumer Credit Line.

We have five findings in this paper. (1) JD.com has rapidly expanded its market share and its asset through introduction of JD.com Consumer Credit Line. (2) JD.com Consumer Credit Line has reduced liquidity in the assets. (3) the assets backed securitization of JD.com Consumer Credit Line effectively complements the liquidity of enterprise assets, but also brings new risks. (4) As an off-balance sheet financing method, the assets backed securitization of JD.com Consumer Credit Line has effectively improved the financial structure of enterprises. (5) The revolving trading structure adopted in the special program provides sufficient cash flow to meet the principal and interest of asset-backed securities.

This article features: (1) This paper systematically introduces the process of assets backed securitization and summarizes the existing financing methods of Internet consumer credit (2) According to the existing data and a series of assumptions, the paper makes a simplified analysis of the structure of the assets backed securitization of JD.com Consumer Credit Line. Then gradually relax the assumptions and finally reach a conclusion.

Keywords: JD.com Consumer Credit Line; Internet consumer credit; assets backed securitization; Liquidity of assets; financing cost

目 录

摘 要 I

Abstract II

第1章 绪论 1

1.1 研究背景目的及意义 1

1.1.1 研究背景 1

1.1.2 研究目的及意义 2

1.2 国内外研究现状分析 2

1.2.1关于信贷资产证券化的研究 3

1.2.2关于资产证券化风险的研究 3

1.2.3研究现状评价 3

1.3 研究内容框架和研究方法 4

1.3.1 研究内容框架 4

1.3.2 研究方法 4

1.4 创新点 4

第2章 资产证券化及互联网消费信贷融资 6

2.1资产证券化 6

2.1.1结构化金融、传统证券化与资产证券化 6

2.1.2资产证券化的分类 6

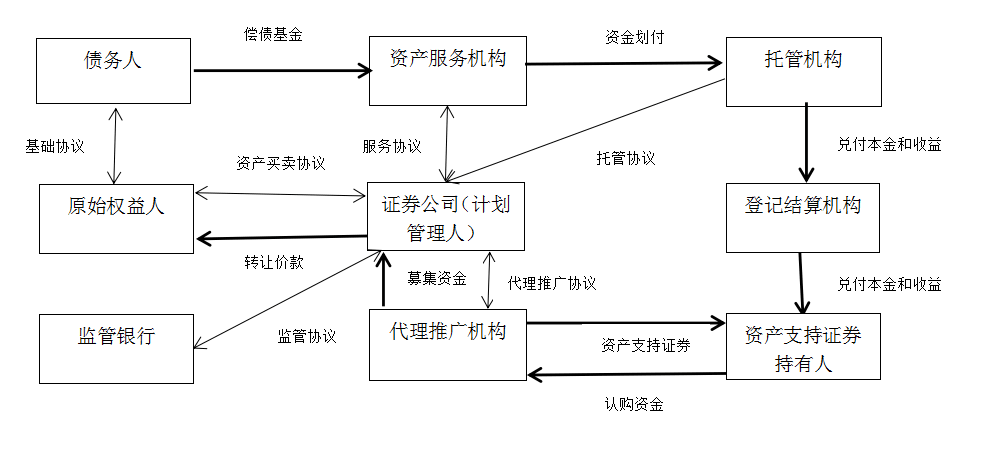

2.1.3资产证券化交易结构与特殊目的机构 7

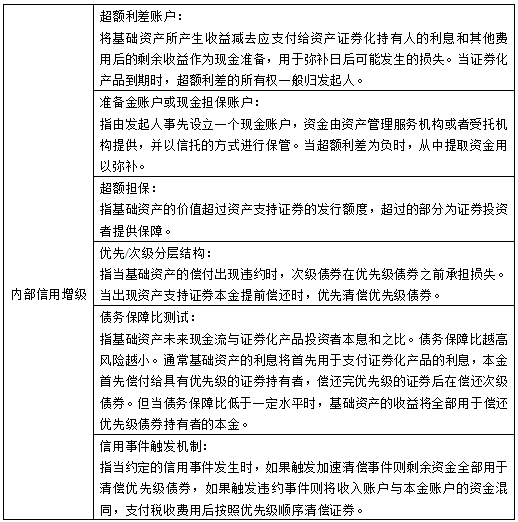

2.1.4信用增级 9

2.2互联网消费信贷融资 11

2.2.1互联网消费信贷质押融资 11

2.2.2互联网消费信贷保理融资 12

2.2.3基于互联网消费信贷的信托贷款融资 12

2.2.4互联网消费信贷资产证券化融资 12

第3章 京东白条消费信贷资产证券化动因 13

3.1京东白条规模的急剧扩大对京东集团资产的流动性提出挑战 13

3.2再投资效率下降 14

3.3拓宽融资渠道 15

3.4降低融资成本 16

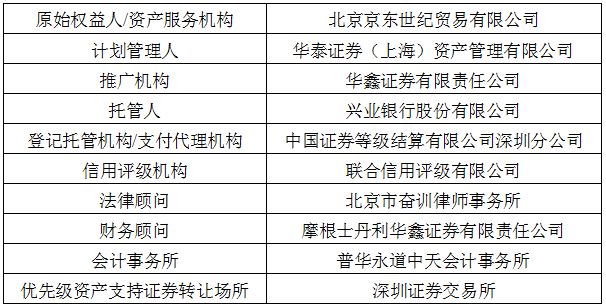

第4章 京东白条消费信贷资产证券化项目 17

4.1相关方的权利义务 17

4.1.1原始权益人的权利义务 17

4.1.2计划管理人的权利义务 17

4.1.3托管人的权利义务 18

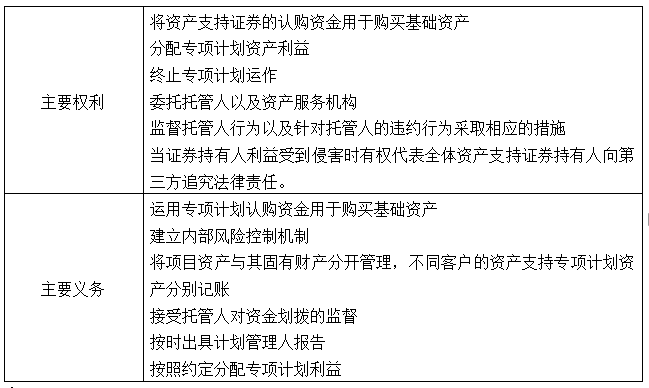

4.1.4资产支持证券持有人的权利义务 18

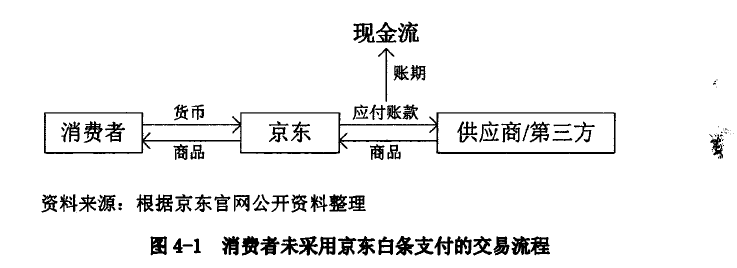

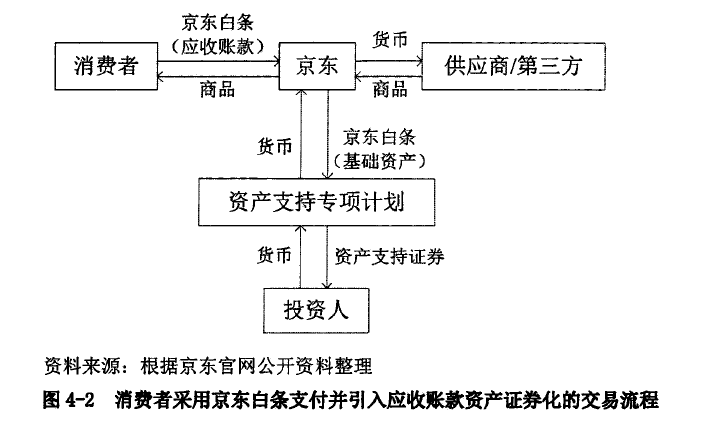

4.2交易流程 19

4.3基础资产 20

4.3.1基础资产的入池标准 20

4.3.2基础资产的构成 20

4.4信用增级 21

4.4.1优先/次级安排 21

4.4.2超额担保 22

4.4.3信用触发机制 22

4.4.4超额利差 23

4.5资产支持证券 23

4.5.1资产支持证券种类及偿付方式 23

4.5.2资产支持证券期限及规模 24

4.6交易资金流转 24

4.6.1账户设置 24

4.6.2未发生加速清偿事件时的分配 25

4.6.3发生加速清偿事件时的分配 27

以上是毕业论文大纲或资料介绍,该课题完整毕业论文、开题报告、任务书、程序设计、图纸设计等资料请添加微信获取,微信号:bysjorg。

相关图片展示: